KarenSoftTM FAS4GST

Certified as GST-compliant by the Jabatan Kastam DiRaja Malaysia with effect from 25th July 2014!

Introduction

![]()

FAS4GST, as enhanced from FASERP, has been updated to be GST compliant by adhering to the Guide to Enhance Your Accounting Software to be GST Compliant issued by the Royal Malaysian Customs had on 13 March 2014.

The salient features expected to be incorporated into a GST Complaint Accounting Software include:

1) Provides the issuance of tax invoice as well as credit/debit note in compliance with GST legislation.

2) Provide a reporting facility for the generation of information necessary to prepare tax returns.

3) Provide comprehensive documentation to assist auditors and users to understand how the system operates.

4) Incorporates adequate internal controls to ensure the reliability of the data being processed.

5) Creates adequate audit trails to assist auditors to understand the flow of events and reconstruct the events if necessary.

6) Has in place archival and restoration of archived data mechanisms to ensure the integrity and readability of electronic records after an extended period.

7) Contains key data elements necessary for business.

8) Allows production of GST Audit File (GAF) by non-specialists (staff who do not have an IT background).

|

JKDM Requirements Checklist |

Complied by FAS4GST |

|

a) Provides the issuance of tax invoice as well as credit/debit note in compliance with GST legislation |

See Chapters 14.3, 15,17,19 and 23 |

|

b) Provide a reporting facility for the generation of information necessary to prepare tax returns. |

See Appendix E and Chapter 5.7.4 (GST03 File) |

|

c) Provide comprehensive documentation to assist auditors and users to understand how the system operates. |

Refers to this User Guide |

|

d) Incorporates adequate internal controls to ensure the reliability of the data being processed |

See Chapter 1.15

|

|

e) Creates adequate audit trails to assist auditors to understand the flow of events and reconstruct the events if necessary. |

See Chapter 24 & individual chapters module by module |

|

f) Has in place archival and restoration of archived data mechanisms to ensure the integrity and readability of electronic records after an extended period. |

See Chapter 8.3.2 |

|

g) Contains key data elements necessary for business

|

System-wide |

|

h) Allows production of GST Audit File (GAF) by non- specialists (staff who do not have an IT background). |

See Chapter 5.7.3 |

The updated product meeting all of JKDM’s requirements is now known as FAS4GST.

How was FAS4GST certified by JKDM as GST-compliant

![]()

Before achieving certification by JKDM, FAS4ST was subjected to certain conditions and a barrage of tests including:

• Attendance at a compulsory Briefing at JKDM HQ at Putra Jaya on 8th April 2014.

• Official application to be a Vendor of GST-compliant Account Software by 29th April 2014.

• Testing against JKDM’s Test Script (containing about 500 transactions from Jan 2016 to Jan 2017)

to simulate all the possible scenarios under GST such as:

a) Purchases (all 12 GST categories)

b) Supplies (all 9 GST categories)

c) Time of supply

d) Deposits received from customers

e) Deemed Supplies

f) Imported Materials

g) Imported Services (Self-recipient Accounting)

h) Purchases from ATMS (Approved Toll Manufacturers Scheme)

i) Purchases under ATS (Approved Traders Scheme)

j) Bad Debt Relief after 6 months

k) Recovery of bad debts in respect of 6-months Bad Debt Relief

l) Bad Debts written off

m) Recovery of bad debts written off

n) Bad Debt Relief for Suppliers if not paid after 6 months

o) Recovery of AP Bad Debt Relief

p) Credit Notes to customers

q) Credit Notes to suppliers

r) Debit Notes to customers

s) Debit Notes to supplier

t) GST Adjustments (2 categories)

• Attendance at a Certification Demonstration on 19th May 2014.

During the demo, FAS4GST has to demonstrate:

a) Compliance to the mandatory requirements for

▸ ARCN

▸ ARDN

▸ APDN

▸ APCN

b) Compliance with formats for

▸ Full Tax Invoice

▸ Simplified Tax Invoice

▸ Self-billed Tax Invoice

c) Live demonstration of the various scenarios as per the test script as above.

d) Provide GST Audit report on the fly for any range of dates.

e) Production of GST Audit File (GAF) for any range of dates.

f) Production of Purchases Listing for any range of dates.

g) Production of Supply Listing for any range of dates.

h) Production of GST03 Return File for any taxable period.

i) Verification of GST03 monthly figure month-by-month and in total to ensure that that it agrees with the figures as per the Test Script.

j) Production of Balance Sheet showing treatment of GST-related Accounts.

k) Production of Profit & Loss Account showing treatment of GST-related Accounts.

• In addition, MWS had to satisfy JKDM certification panel as to:

b) Training methodology

c) Software support methodology

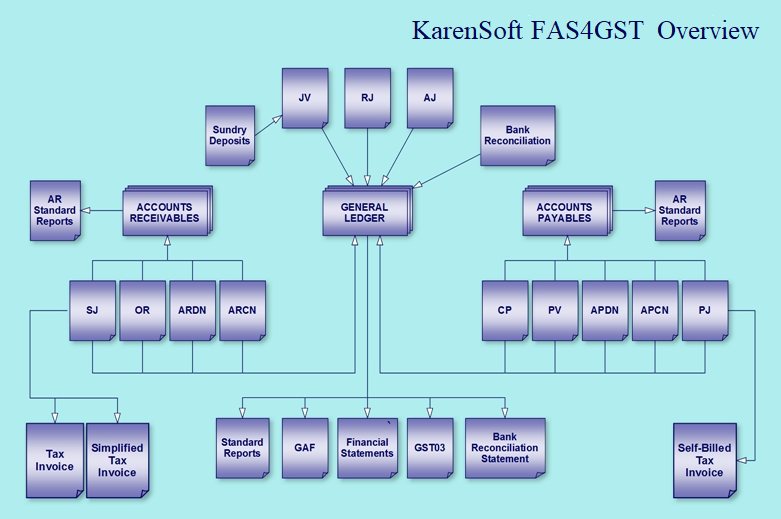

FAS4GST Overview

![]()