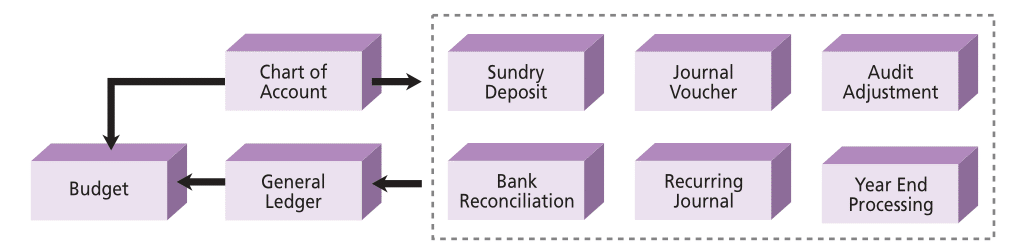

| General Ledger |

|

•

|

Keep a complete list of business accounts and organize them by grouping, type and cost category under Chart Of Account. You can also view the general ledger listing in detail as well as general ledger history.

|

|

•

|

Budget module provides a monthly and running budget for each individual account.

|

|

•

|

Use Sundry Deposit to register your sundry deposit and generate journal vouchers.

|

|

•

|

The Audit Adjustment module helps you make adjustments to audited accounts for last year-end and helps you refresh your opening balance as per audited accounts.

|

|

•

|

Save time, reduce margin for human error and eliminate unnecessary monthly routine data entry by using Recurring Monthly Journal. It allows monthly double entries whereby you can enter one debit against multiple credits or vice versa.

|

|

•

|

Journal Voucher (GL Journal) enables you to key in daily general ledger journal entries. It also allows you to enter double entries such as one debit against multiple credits or vice versa.

|

|

•

|

You can use Bank Reconciliation module to help you reconcile the balance of the bank account in the books against the balance in the bank statement. You can also print out your bank reconciliation statement reports.

|

|

•

|

One click is all it takes for you to begin Year-End Processing with the end of each financial year. Once you are done with Year-End Processing, the general ledger will be transferred to history files for analysis purposes.

|

| |

General Ledger General Ledger

|

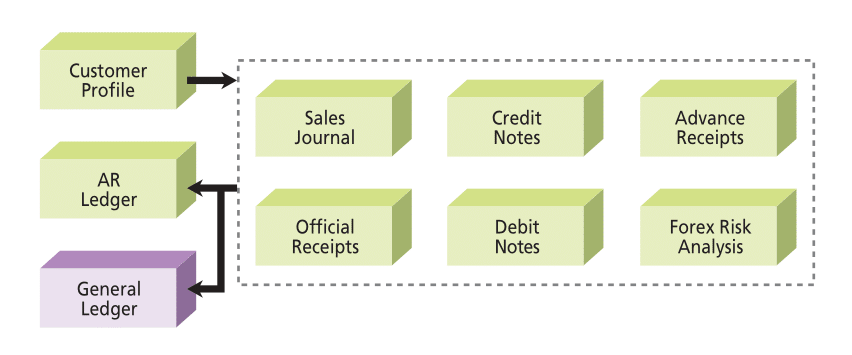

| Accounts Receivable |

|

•

|

Customer Profile is designed for you to capture information pertaining to each trade and non-trade customer accounts code, as well as to view detailed customer ledger listing.

|

|

•

|

You can use Sales Journal to key in daily sales journal entries where you can allow one debit AR control account to be compared against multiple credit entries.

|

|

•

|

You can send Credit Notes to your customers if there is an overstated amount in the previous invoice. Credit Notes can be tagged with invoices.

|

|

•

|

Official Receipts module lets you enter daily receipts received from customers. You can apply more than one invoice for each customer code. This system will automatically calculate the gains or losses for each transaction.

|

|

•

|

Debit Notes can be sent if there is an understated amount in an invoice. Debit Notes are generated when you need to add on to the amount owed by your customer.

|

|

•

|

Occasionally, you may come across advance collection. If an invoice is issued for a particular collection, you need to do an adjustment. Using Advance Receipts or Open Credit module, you can conveniently write off an invoice against the advance collection.

|

|

•

|

AR Forex Risk Analysis module enables you to compute the unrealised gains or losses based on the simulated foreign exchange rate.

|

| |

Accounts Receivable Accounts Receivable

|

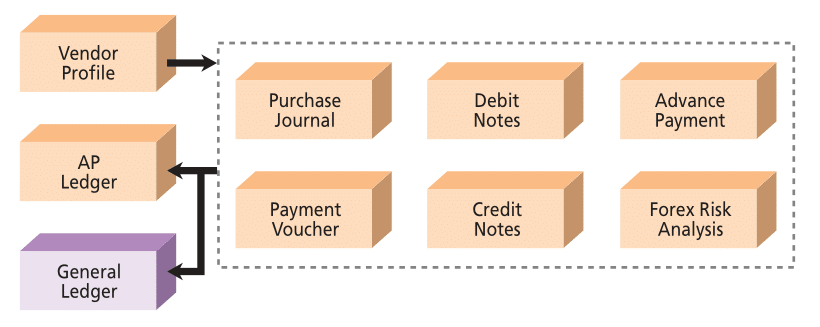

| Accounts Payable |

|

•

|

Vendor Profile lets you capture information pertaining to each trade and non-trade vendor accounts code, as well as view detailed vendor ledger listing.

|

|

•

|

You can enter daily purchase journal entries where one AP control account is used as credit against multiple GL codes as debit under Purchase Journal module.

|

|

•

|

You will receive a Debit Note from your supplier if there is an overstated amount in your purchase invoice. Debit Notes can be tagged to purchase invoices.

|

|

•

|

Payment Voucher module enables you to enter daily payments to your vendor. You can apply more than one invoice to each vendor code. Gains or losses on the forex exchange will be calculated by the system.

|

|

•

|

You can send a Credit Note to your supplier if there is an understated amount in your purchase invoice. Credit Notes will be generated to add on the amount owed to a particular vendor.

|

|

•

|

Advance Payment or Open Debit module facilitates invoices to be written off against advance payments. This is the opposite of Open Credit. Payments can be made without any invoice being issued for a particular payment.

|

|

•

|

AP Forex Risk Analysis module lets you compute the unrealised gains or losses based on the simulated foreign exchange rate.

|

| |

Accounts Payable Accounts Payable

|

| Optional Modules |

|

•

|

Overdue Interest

This module enables you to identify, with the aim of charging interest towards any outstanding invoice after a certain period of time.

|

|

•

|

Contra with Accounts Payable

You can offset the amount for a particular company which is also a creditor. Just identify the amount recorded in the accounts receivable so that it can be offset with the accounts payable for a similar company.

|

|

•

|

Contra with Accounts Receivable

This module is created for you to offset the amount for a particular company which is also your debtor. Just identify the amount recorded in the accounts payable so that it can be offset with the accounts receivable for a similar company.

|

|

•

|

Post-dated Cheque Management

You can keep track of post-dated cheques especially regarding cheque dates, clear dates and transaction dates. You can also print out official receipts.

|

|

•

|

Automated Cheque Payment Processing

You can automate the cheque printing process. Cheque, payment advice and payment vouchers printing are included.

|

|

•

|

GL Consolidation

This module is applicable in a multi-company environment where you are allowed to consolidate all general ledger accounts from any number of subsidiaries or branches into the group account.

|

|

•

|

Treasury Management

A comprehensive solution allows you to manage cash flow, calculate reinvestments, track cash and asset flow; and which includes the modules such as :

▸ Fixed Deposit Register

▸ Trade Financing Register

▸ Currency Hedging

▸ Hire-Purchase Register

▸ Lease Register

▸ Cash Flow(Statutory Cash Flow)

|

|

•

|

Taxation Management

Company self tax assessment.

|

| |

|

| Others |

|

•

|

Batch Posting

All posting within the KarenSoft FAS are on a batch basis.

|

![]()

![]()